Every Airbnb host wants to protect their property from damage. Airbnb Host Damage Protection offers up to $3 million in coverage for eligible losses caused by guests during their stay.

Whether it’s broken furniture, stolen electronics, or a stained carpet, Airbnb Damage Protection will save you from losses. In this guide, we’ll discuss the eligible scenarios or damages that hosts need to know. We also prescribe a process of filing for Airbnb hosts’ damage protection and receiving coverage as soon as possible. Let’s start discussing.

What is Airbnb Host Damage Protection?

It is a built-in safety net designed to support Airbnb hosts in the event of any damage caused by a guest during a reservation. Airbnb has developed AirCover to help hosts recover their losses. Airbnb Hosts Damage Protection is a part of the AirCover. Airbnb offers up to $3 million in coverage for eligible physical damage or losses.

Note that it is not a traditional insurance policy you purchase.

These coverage offerings are automatically applied with every booking made on your property. It ensures that you won’t have to bear the financial burden if a guest damages furniture, appliances, or valuables of the property.

What Does Airbnb Host Damage Protection Cover?

Airbnb Host Damage Protection coverage is designed to ease the financial burden when guests cause damage. Property damages have a wide range of varieties and frequencies, such as:

Damage to Property Or Belongings

If your Airbnb property suffers physical damage from guests, Airbnb will provide coverage according to the intensity of the damage. Damages may include holes in walls or broken windows. Airbnb will also ensure you are protected against damage to property belongings. You can file for Airbnb host protection for damaged furniture, ruined appliances, and destruction of décor or electronics.

Coverage also extends to valuables such as artwork, collectibles, and jewelry. However, you can apply only by providing proof of ownership and a value certificate. To approve host protection claims on Airbnb, you need to provide purchase receipts, photos, and other verifiable documents.

Vehicle Damage

If you allow guests to park on your property and cause any damage to your car, boat, or other vehicle, it may be covered by Airbnb. So, you can file a claim if a guest backs into your parking space and scratches your motorcycle while moving luggage.

If damage occurs, you must immediately upload the necessary photographs and documents to facilitate coverage. However, usual tire scuffs or minor dents from prolonged use will not qualify for a claim.

Pet-related Damage

Sometimes you’ll face guests with their pet animals, which they haven’t mentioned at booking. That pet can cause damage by chewing furniture, scratching floors, or soiling carpets. Don’t worry, Airbnb may support you with the cleaning, repair, or replacement costs.

The key here is proof of damage linked to the pet and documentation that the pet was present at the time of the incident. Proof could be photos of incidents or communication logs of your guest. However, if you allow pets on your property listing, then Airbnb will not accept the claim.

Unexpected Cleaning Costs

Airbnb property hosts are responsible for standard post-checkout cleaning. However, when guests leave behind excessive messes, such as deep stains or biohazards, specialized cleaning services become necessary. In such cases, Airbnb may cover the cost of these services under its Host Damage Protection.

To qualify for coverage, you must provide before-and-after photographs clearly showing the affected area. Maintaining a strong Airbnb cleaning management process helps you document issues quickly and ensures a faster resolution when filing claims. A well-organized cleaning system also minimizes the risk of disputes and keeps your property guest-ready at all times.

Lost Income

Sometimes, guests cause such extensive damage that it renders the property unfit for the next reservation. This income loss from canceled bookings will be covered by Airbnb host protection. This is particularly valuable if your calendar was booked in advance and a previous guest caused damage to the property. To claim the host coverage, you have to file on the Airbnb Help Center with proper documentation that supports the loss of income.

What Is Not Covered by Airbnb Host Damage Protection?

In addition to covered matters, Airbnb host protection does not apply to other issues. Read about those damage matters that Airbnb does not cover:

Wear and Tear

Airbnb does not cover normal wear and tear that occurs over time from regular use. For example, faded paint, worn-out mattresses, or minor scuff marks on walls. Airbnb expects hosts to take good care of their properties themselves. So, these natural aging processes of a property are not qualified for host protection.

Acts of Nature

You can not file a claim for natural calamities such as floods, earthquakes, hurricanes, wildfires, or lightning strikes. These events fall outside the guest’s control and are usually handled through your homeowners’ or rental insurance. If your property is located in a disaster-prone area, Airbnb strongly recommends purchasing property insurance to fill any coverage gaps.

Cash or Financial Instruments

Airbnb does not recognize any loss during a guest’s stay in terms of cash, cryptocurrency, stock certificates, or similar items. You should avoid storing these types of valuables on-site and always use a safe deposit box.

Routine Cleaning or Upkeep

Vacuuming, changing linens, washing dishes, and taking out the trash are all part of regular cleaning. If any damage occurs during the standard cleaning process, Airbnb does not recognize it as a covered incident. Host Damage Protection only applies to extraordinary cleaning costs, like biohazards or deep sanitation.

Damage or Injuries Covered by Liability Insurance

If a guest is injured on your property or their belongings are damaged, it falls under Airbnb’s Host Liability Insurance. Similarly, Airbnb won’t bear the costs of lawsuits or third-party injury claims through this program. So, the Airbnb host protection only activates for verifiable damages caused by guests.

Excessive Use of Utilities

If a guest leaves the AC running for days, takes long showers, Airbnb does not provide compensation for excessive use of electricity, water, or gas. These types of expenses are considered part of the hosting business. You can help manage this by using smart thermostats or setting clear usage rules in your house manual.

Damage Caused by Unauthorized Guests

Airbnb may reject claims for damage caused by unregistered guests. However, if you report this unauthorized entry on time, Airbnb will cover you. For complete protection, consistently enforce guest limits and document any incidents of rule-breaking as they happen.

How to File a Damage Protection Claim?

Filing a claim under Airbnb Host Damage Protection is a structured process that requires a certain amount of time to complete. You should follow each step precisely and submit the necessary documentation right after identifying the incident. Here’s a clear step-by-step guide to complete an Airbnb damage protection claim filing:

1. Document the Damage

After discovering any damage during the guest’s check-out, document everything immediately. Take high-resolution photos and videos from multiple angles. Take note of any property rule violations or missing items.

If possible, gather repair estimates, receipts, or invoices that prove the damage cost. You must document every detail of the damage caused by the guest before filing a claim.

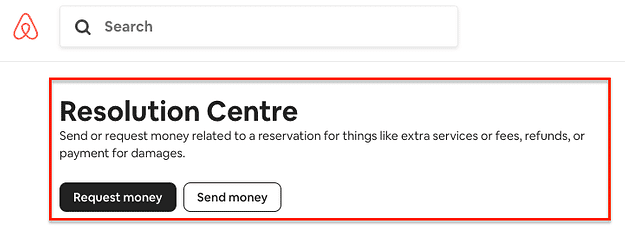

2. File a Resolution Request Within 14 Days

You now have evidence of damage to your property caused by the guest. You must file within 14 days of the guest’s checkout, or before your next guest checks in.

Go to Airbnb’s Resolution Center to file a damage claim. Select “Request money,” and choose the “Damage or loss” option. Now, upload all relevant evidence to support the claim and submit the request. Be specific in describing the situation, damaged item, and the cost or loss amount. Missing this 14-day window can make you ineligible for consideration, even if your claim is valid.

3. Try Resolving with the Guest

Airbnb always considers responses from both ends of Airbnb users. Airbnb gives guests 24 hours to respond once a request is submitted. In many cases, guests will agree to pay for minor damage. Clear and polite communication resolves the issue easily without any complexity. If the guest refuses to pay or doesn’t respond, you can move to the next step.

4. Escalate to Airbnb with Full Documentation (Within 30 Days)

If the guest doesn’t settle, you’ll need to drop your claim to Airbnb under the Host Damage Protection policy. You must do this within 30 days of the incident. Attach the following documents while applying:

Case-related photos/videos

Guest communication logs

Damage repair estimates

Purchase receipt for item damage

Proof of ownership & additional.

In some regions (like Washington State), a third-party insurer may review your claim on Airbnb’s behalf. Airbnb will guide you through the process while your claim is being processed.

5. Wait for Airbnb’s Review and Reimbursement

Airbnb will assess your obligation and supporting documents. If approved, they’ll notify you and provide coverage through Host Damage Protection (up to $3 million). This verification processing time varies depending on the complexity and value of the host claim. It can even take 4-7 weeks or more to process a damage claim.

Airbnb Host Damage Protection vs. Airbnb AirCover for Hosts

In simple terms, Airbnb Host Damage Protection is just one part of a larger program called AirCover for Hosts. Here is a comparison of these:

Comparison of Coverage, Limits, and Eligibility

Airbnb Host Damage Protection focuses explicitly on property damage caused by guests. The coverage limit is up to $3 million. This only applies to damage caused by guests after confirming the Airbnb reservation.

On the other hand, AirCover for Hosts is the core umbrella that offers:

- Host Damage Protection (up to $3M)

- Host Liability Insurance (up to $1M) for third-party property damage

- Identity verification and reservation screening

- 24/7 support service

Which One Is Automatically Included?

Both Host Damage Protection and AirCover for Hosts are automatically included with every booking made through Airbnb. There’s no need to sign up separately or pay any extra fee to Airbnb. This gives hosts easy access to both property and liability protections.

When Hosts Might Need Additional Insurance?

Airbnb strongly recommends that hosts carry additional short-term rental insurance, and for good reason. Because AirCover has its own limits, and doesn’t serve the purpose of property insurance.

You may need additional coverage if you:

- Own a luxury property with valuables.

- Have multiple listings and looking for commercial protection

- Want protection from long-term income loss or large expenses

Limitations and Exclusions of Airbnb Host Damage Protection

Airbnb Host Damage Protection offers valuable coverage to every host. However, this acts as a secondary measure, which is only applicable to resolve the damage issue with the guest, and it requires strict documentation. The claim also has 14 14-day request filing deadline. You must also submit it for official review within 30 days.

Here is the list of essential exclusion cases for Airbnb host protection. Airbnb will not cover you for these scenarios:

- Normal wear and tear

- Acts of nature (e.g., floods, earthquakes)

- Theft of cash, coins, or financial instruments

- Routine cleaning costs

- Damage after guest checkout

- Injuries or third-party liability (handled under Host Liability Insurance)

- Damage caused by unauthorized guests, if not documented

How to Maximize Your Protection as an Airbnb Host?

Remember, an Airbnb hosts always take good care of their properties. Protection starts with carefully approving guests through careful profile reviews and policy discussions. You should:

- Keep your listing information updated.

- Follow a professional Airbnb host checklist.

- Communicate the house policy.

- Fix common guest check-in issues.

Additionally, for extra protection, consider using security deposits through a third party and insurance to cover damage costs. Remember that Airbnb’s coverage doesn’t replace traditional insurance, so plan your short-term rental policy wisely.

How STR Assistance Can Help with Airbnb Host Damage Protection?

The Airbnb host damage protection process is time-sensitive and requires detailed documentation to get approved. At STR Assistance, our experienced team has successfully guided hundreds of hosts through the claim process — from gathering proof to submitting claims with 100% accuracy.

As a leading Airbnb Virtual Assistant provider, we specialize in short-term rental management and understand Airbnb’s policies inside out. Whether it’s a stained sofa or lost income due to guest damage, we’re here to ensure your claim is processed correctly and quickly.

Does Airbnb Host Damage Protection cover theft?

Yes, Airbnb Host Damage Protection does cover theft, but only under specific conditions. If the item is taken by the guest or their invitee during a confirmed reservation, you can file to coverage. You have to provide proof of ownership and evidence of the occurrence. Losing cash, securities, or other financial instruments is not covered under Airbnb host coverage.

How long do I have to file a damage claim?

You must initiate a claim within 14 days of the guest’s checkout. However, the filing must be done before the next guest checks in. If the guest doesn’t respond or pay, you can request to follow up the claim by Airbnb. This escalation needs to be requested within 30 days of the incident.

What if a guest refuses to pay for damages?

If the guest refuses or ignores your resolution request, you can escalate the claim within the Airbnb platform. Airbnb will review the documentation you provide and may reimburse you through Host Damage Protection, provided the damage qualifies and you meet all deadlines.

Can I charge a security deposit in addition to using Airbnb’s protection?

Airbnb itself no longer allows security deposits to be collected through its platform. However, you can use third-party tools or software to collect a separate security deposit outside Airbnb. Please ensure that this is disclosed in your listing and does not violate Airbnb’s terms of service.

Conclusion

Airbnb Host Damage Protection provides valuable peace of mind by covering a wide range of guest-related damages, including broken furniture, stolen valuables, and lost income. But like any protection, it has its limits. Understanding what’s covered, what’s not, and how to properly file a claim can make a big difference in how quickly and successfully you’re reimbursed.