Table of Contents

Being an Airbnb host, you must have faced this situation where you are juggling bookings, cleaning schedules, guest messages, and trying to figure out where all your money went last month. Tax time rolls around, and suddenly you’re digging through emails, receipts, and bank statements. It’s stressful, messy, and it takes the joy out of hosting.

That’s where Airbnb accounting and bookkeeping come in. With proper accounting and bookkeeping, you stay on top of your finances, avoid tax surprises. You get to know how profitable your rental is.

In simple terms, Airbnb bookkeeping is the process of recording your daily income and expenses from hosting. Airbnb accounting takes it a step further by organizing those records to give you a full financial picture, helping with tax reporting, budgeting, and smarter decision-making.

Today, we will discuss everything you need to know about Airbnb accounting and bookkeeping, key challenges hosts face, how you can set up your accounting system, and tax considerations with common mistakes to avoid.

What is Airbnb Bookkeeping and Accounting?

Airbnb bookkeeping and accounting involve tracking your rental income, expenses, and taxes to keep your finances organized, understand your profits, and stay compliant with tax rules. Bookkeeping handles the day-to-day records, while accounting gives you a full view of your income and expenses, so you can improve and grow.

Airbnb Bookkeeping:

Airbnb bookkeeping means keeping track of the money coming in and going out of your short-term rental. This includes what you earn from bookings and what you spend on things like cleaning, supplies, and repairs. It’s a daily habit of recording everything so you always know where your business stands. Good bookkeeping helps you stay organized, see how much profit you’re making, and be ready for tax time, without stress or surprises.

Key aspects of Airbnb bookkeeping:

- Tracking Income

- Tracking Expenses

- Maintaining Records

- Preparing Financial Statements

- Categorizing Transactions

- Ensuring Account Balance

- Compliance with Tax Regulations

Airbnb Accounting:

Airbnb accounting is the process of keeping track of all the money your rental business makes and spends. This includes income from bookings, expenses like maintenance and cleaning, and taxes. Good accounting helps you stay organized, make smarter business decisions, and avoid issues during tax time. It also helps you spot which properties are most profitable and where you can save money.

You also have accounting responsibilities to:

- Yourself & Partners: to ensure your business is profitable.

- Homeowners & Investors: to report earnings clearly and build trust.

- Tax Authorities: to stay compliant and pay only what you owe.

Key Aspects of Airbnb Accounting:

Income Tracking

Expense Tracking

Taxes

Bookkeeping

Profitability Analysis

Key Accounting Challenges for Airbnb Hosts

Managing accounting and keeping bookkeeping on track is not easy. There will be several challenges Airbnb hosts face. Here we are mentioning very common challenges you may face. By knowing them first, you will be able to tackle them.

Handling multiple income streams (Airbnb, VRBO, direct bookings)

Many Airbnb hosts list properties on multiple platforms, including Vrbo, Booking.com, and direct booking websites. So, it is obvious that each platform has its own fee structures, and pays out timelines, and income reporting methods. Thus, it makes it difficult to manage and consolidate these diverse streams.

This can be time-consuming and confusing. It will be more challenging when trying to get an accurate picture of total earnings and reconcile monthly finances.

Expense Categorization

Properly categorizing expenses is important for financial analysis and tax reporting. But categorizing these properly for accounting and tax purposes can be challenging. How?

Have you ever misclassified the accounts’ expenses? If you know, then you know misclassification may lead to inaccurate financial reports, missed deductions, or issues during tax audits. It becomes even more complicated when expenses overlap.

For example, shared internet for multiple properties.

Common categories include:

- Cleaning and maintenance

- Utilities

- Property management fees

- Marketing and advertising

- Insurance

- Repairs and supplies

Local Tax Rules & Rental Fees

Being short-term rental hosts, you must navigate complex tax obligations. This can vary by location. These may include :

Transient occupancy taxes

Sales taxes

City or county licensing fees

Some areas also have specific compliance requirements such as registration, permitting, and remittance of local taxes. It is tough to keep up with local law challenges. You may mess up proper reporting and payment, and all these seem a big accounting burden.

If any hosts need to manage properties in different cities or states, then it makes the situation worse.

Handling refunds, cancellations, and disputes

One of the most complex aspects of Airbnb bookkeeping is dealing with unexpected changes in guest stays. Your guests may have canceled last time, or there are disputes, or an issue with the refunds. All these directly impact your income records and adjust the logged transactions.

A very common challenge is that platforms like Airbnb often deposit earnings before a guest completes their stay. If a guest cancels midway or disputes a charge after the stay, you must go back and adjust your books. As a result, you won’t be able to stay consistent with the monthly income reporting.

Tracking Multiple Reservations

Airbnb often combines earnings from multiple reservations into one payout. This makes it difficult to understand which listing or booking of the payment came from. If you manage several properties or rooms, because of this confusion, you may find it problematic to use the Airbnb account.

It will be a problem to match each booking with the correct payout, especially when platform fees, cleaning charges, and taxes are deducted before the payout hits your account.

Separating personal and rental finances

Many Airbnb hosts make the mistake of using the same bank account and credit cards for both personal and rental-related transactions. Won’t this make it hard to distinguish your business and personal spending?

This overlap not only complicates bookkeeping but can also create problems during tax time. You may miss out on valid deductions. Or try to claim personal expenses by mistake.

How to Set Up Your Airbnb Accounting System?

Setting up your Airbnb accounting system is easy, and you do not need to have good software knowledge. First, choose which accounting method you are comfortable with, select a software, and start documenting and organizing everything.

Separating personal and rental finances

You can either start with the cash accounting method or the accrual method. Here is what they actually mean.

Cash vs. Accrual Accounting

Cash accounting is easier. It is a more common method for most Airbnb hosts. It means you record income and expenses only when the money actually moves. So, if a guest pays you today, you write that income down today. If you pay for cleaning services next week, you record that cost next week when the payment happens. It’s a simple way to keep track of your money.

On the other hand, accrual accounting is a bit more detailed. With this method, you record income and expenses when they are earned or owed. Even if the payment hasn’t been made yet. For example, if a guest books your place in April but pays in May, you still record that income in April, the month the booking was made.

Which method is best for Airbnb hosts?

- If you’re a solo host or just getting started, cash accounting is usually the better choice. It’s simple and goes with your actual cash flow.

- If you’re scaling your business or want a more detailed view of your performance month by month, accrual accounting may give you more control.

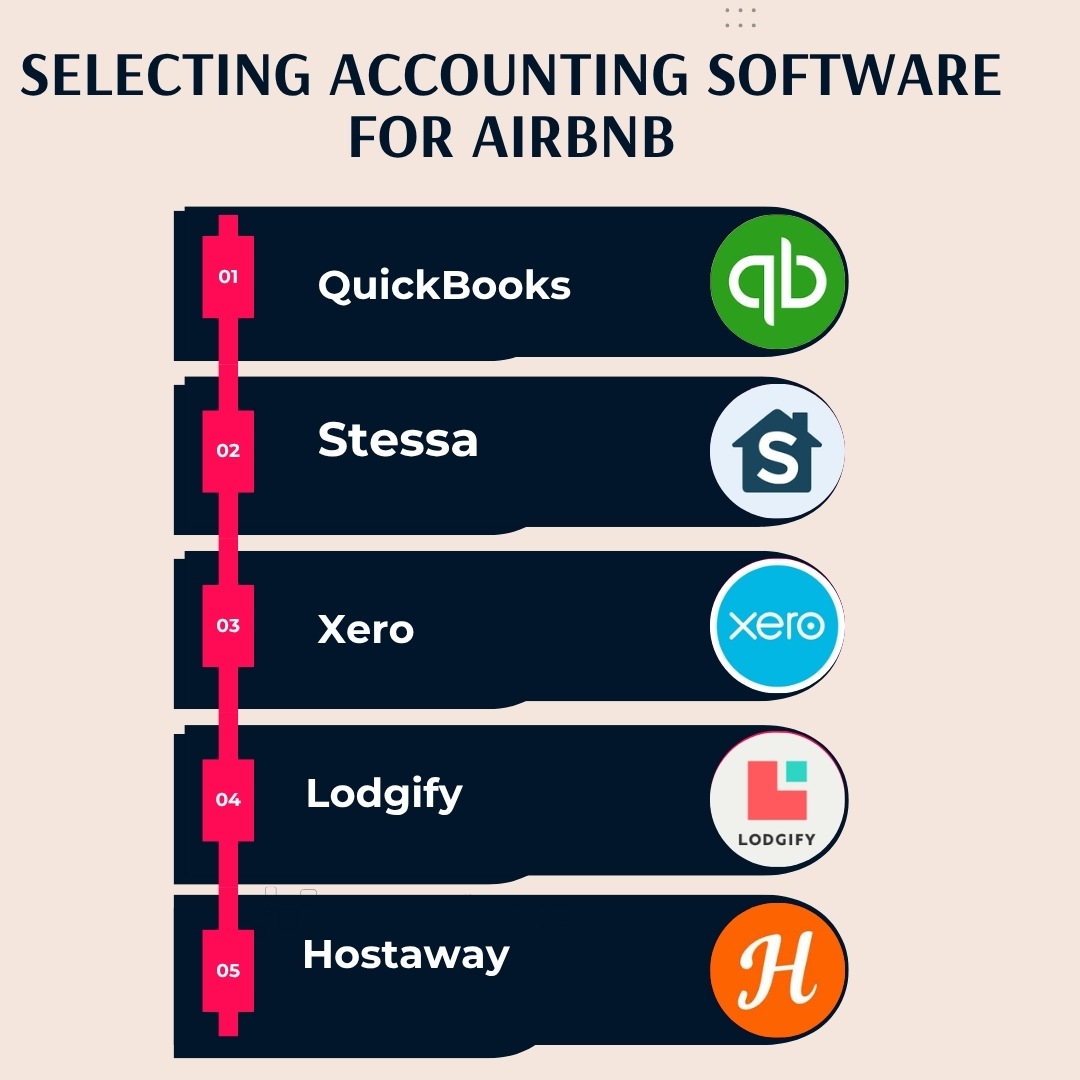

Selecting Accounting Software for Airbnb

Using software will make your job easier. Set up your accounting with a tool that is comfortable to you. Here is a list of popular tools:

QuickBooks: QuickBooks helps you track income and expenses, organize receipts, and run profit and loss reports. It can also be used for tax filing and general business accounting.

Stessa: Stessa is built for rental property owners. It automatically tracks income and expenses from connected bank accounts. Also, monitor property performance and generate tax-ready reports.

Xero: Xero offers cloud-based accounting features like invoicing, expense tracking, and real-time financial reporting.

Lodgify : Lodgify is a vacation rental software with built-in booking and payment tracking.

Hostaway : Hostaway offers automation tools along with financial tracking. It also integrates with Airbnb and other channels to simplify income reporting and expense management.

Organizing Financial Documents

Next, you need to organize every piece of financial documentation you have. Keep clear records of all your bookings and expenses, such as :

- How much did you earn

- The platform used (like Airbnb, Vrbo, or direct bookings)

- Any special fees or discounts

- Cleaning fees

- Maintenance costs, supplies, and utilities

- Other costs related to hosting

It is wise to keep copies of all tax documents, such as 1099-K forms, local lodging tax records, and receipts for tax-deductible expenses. Store these records in an organized way, either digitally or manually.

Many hosts prefer digital record-keeping since it’s faster, easier to back up, and accessible from anywhere. However, if you prefer paper files, just make sure everything is labeled and stored safely.

How to Track Your Airbnb Income and Expenses

At first, you may not focus much on tracking your Airbnb income and expenses. But by the time time passes, when everything becomes a mess, you can not figure out where your profits come from or where you are spending more, you will feel the necessity of tracking everything. So it’s better that you start now. Here is how you can do it.

Open a dedicated bank account

First, you need to open a separate bank account that will be dedicated to your hosting business. Don’t mix your Airbnb money with your personal money. This helps you see exactly what’s coming in from bookings. Easily keep track of what’s going out for expenses like cleaning, supplies, or repairs. It also makes things a lot easier when tax season comes around.

Choose a tracking method (manual or software)

To track your rental income and expenses, which way do you want to go, using a manual method or a tool? If you are comfortable using spreadsheets to record everything manually, you can do that. But this surely will become problematic when you expand your rental business or have multiple listings.

Then a software is the best to use. Tools like QuickBooks, Stessa, or even apps made for Airbnb hosts. Pick something that fits your style. Just make sure you’re logging everything in one place so nothing slips through the cracks.

Record income by booking source

Not all bookings come through Airbnb if you have a listing on multiple rental platforms. You might also get guests from Vrbo, Booking.com, or direct bookings. Note where each guest came from and how much you earned. In this way, you will be able to distinguish between which platforms perform best and how much they’re charging in fees.

Log every expense with category tags

Every time you spend money on your rental, write it down. It is maybe its toilet paper, linens, or a handyman. For efficiency, add a category tag like “supplies,” “cleaning,” or “maintenance.” This helps you see where your money is going and makes it easier to claim deductions later.

Reconcile monthly using Airbnb reports or bank statements

At the end of each month, match up your records with your Airbnb transaction history or your bank statements. Airbnb provides payout reports. It shows exactly what they paid you and when. This helps you catch errors, missed payouts, or forgotten expenses.

Generate monthly profit and loss statements

Create a simple report that shows your total income and total expenses for the month. This is called a profit and loss (P&L) statement. It tells you how much you’re actually making, not just what Airbnb sent you. Use this to plan ahead, cut costs, or grow your business smarter.

Tax Considerations for Airbnb Hosts

As an Airbnb host, everything you earn from your rental, including cash, tips, or vouchers, is taxable. You’ll usually report this income on Schedule E of Form 1040. But if you offer hotel-like services (like daily cleaning or meals), you might need to use Schedule C instead.

Also, if you make over $20,000 or have 200+ bookings in a year, Airbnb will send you a 1099-K form. Even if you don’t get one, you’re still required to report all your rental income when filing taxes.

Here are the tax considerations Airbnb hosts need to know.

1. Income Tax Obligations

Reportable Income: All Airbnb earnings, rental fees, cleaning charges, and extra services are taxable and must be reported.

Tax Forms: In the U.S., Airbnb may issue a 1099-K if you meet income thresholds. But even without the form, you must still report your full rental income.

14-Day Rule: If you rent out your property for fewer than 15 days annually, that income may be tax-free (depending on local laws).

2. Local Taxes & Licensing

Occupancy Taxes: Many regions require you to collect and remit tourist or lodging taxes, even if Airbnb collects some on your behalf.

Licensing: Some cities require registration, permits, or compliance with zoning laws.

Example: Victoria, Australia, charges a 7.5% levy on short-stay rentals to support social housing.

3. VAT / GST

When It Applies: Some countries require you to collect VAT or GST on your rental services.

On Service Fees: Airbnb often adds VAT/GST to its own service fees.

Host Action: You may need to register for VAT/GST and list your ID in your Airbnb settings.

Common Mistakes to Avoid in Airbnb Bookkeeping

Here are some common mistakes when you start proper Airbnb Bookkeeping. You need to be extra careful with,

Not documenting expenses properly means you might miss out on valuable tax deductions for things like repairs, maintenance, and renovations.

Misinterpreting Airbnb’s 1099-K form can lead to overpaying taxes, as it reports gross income, not net, before subtracting Airbnb fees, refunds, or cancellations.

Overlooking local tax laws and license requirements may result in non-compliance, fines, or legal issues, especially if your city requires special permits or registration.

If you mix personal and business finances, it creates confusion and makes it difficult to track the true profitability of your Airbnb operations.

When hosts fail to keep every receipt, even for small purchases, it can cause you to miss deductible expenses and leave gaps in your financial records.

Not accounting for refunds and cancellations leads to inflated income records and inaccurate profit reporting.

Forgetting to log cash transactions, like payments to a local cleaner or handyman, results in incomplete expense tracking.

Ignoring booking platform fees, such as Airbnb service charges, can distort your real income figures.

Not setting aside money for taxes can cause financial stress when quarterly or annual tax payments are due.

When any Airbnb host uses inconsistent expense categories, it makes it harder to understand their finances or identify trends over time.

Failing to reconcile bank deposits with booking records may cause income discrepancies that are hard to explain during an audit.

Not backing up records or using cloud storage risks losing important documentation due to device failure or accidental deletion.

Common Mistakes to Avoid in Airbnb Bookkeeping

A bookkeeper takes care of the daily money tasks. An accountant looks at the bigger picture and gives financial advice.

When to Hire a Bookkeeper:

- You can’t keep up with your bills and expenses.

- Your bank accounts aren’t matching up.

- Payroll is messy and stressful.

- Your business is growing, and you need help keeping track of everything.

When to Hire an Accountant:

- You need help with taxes and planning.

- Financial reports confuse you.

- You’re applying for a loan or want to attract investors.

- Your business is now too big for basic bookkeeping.

Need Both? That’s common! A bookkeeper keeps your records clean and organized. An accountant uses that info to give advice, help with taxes, and plan for the future.

Can I Hire a Virtual Bookkeeper For Airbnb?

Virtual assistants are so popular and more helpful as an extra hand in managing your Airbnb business. From handling your guests to helping with bookkeeping and accounting, an Airbnb virtual assistant can work right beside you, but remotely.

So, if you are thinking of getting extra help, you absolutely can go for a virtual bookkeeper for Airbnb. And here at STR Assistance, we already have Bookkeeping VAs, who are experts using the tools, and have already handled tons of Airbnb hosts to make their accounting management organized.

We have helped hosts who were in a total mess by not keeping any financial records or tracking anything. Our VAs helped them out by organizing every piece of financial record, and furthermore, with the tax preparation.

We can help you, too, with your bookkeeping management. Contact us for your Airbnb VA today.

FAQs

1. How Are Airbnb Expenses Calculated?

Expenses are calculated by adding up all costs related to hosting, like cleaning, repairs, supplies, and platform fees.

2. When Is Airbnb Income Reported on a Tax Return?

Income is reported in the year you receive it (cash method) or when it’s earned (accrual method), usually using Schedule E or Schedule C.

3. Do I need a business bank account for Airbnb?

It’s not required, but having a separate business account helps keep your Airbnb income and expenses organized.

4. What expenses can I deduct as a host?

You can deduct things like cleaning fees, utilities, repairs, mortgage interest, property management costs, and Airbnb service fees.

5. Should I use cash or accrual accounting?

Most hosts use cash accounting because it’s simpler, but accrual works better if you manage many bookings in advance.

6. How do I track expenses for co-hosting or revenue share?

Use spreadsheets or accounting software to split income and expenses fairly between hosts and co-hosts based on your agreement.

7. Can I hire a virtual bookkeeper for Airbnb?

Yes, many virtual bookkeepers specialize in short-term rentals and can help you stay organized and ready for tax time.

From Bookings to Cleanings and Guest Communication, We Manage It All for Seamless Operations.

We are a dedicated team of virtual assistants specializing in managing and optimizing short-term rental properties. With a passion for simplifying the lives of property owners, our team brings years of expertise in guest communication, pricing optimization, cleaning coordination, and overall property management across multiple rental platforms like Airbnb, Vrbo, and Booking.com.

Join 70,000+ professionals and become a better social media marketer. Get social media resources and tips in your inbox weekly.